NASDAQ does not use this value to determine compliance with the listing requirements. "Market Cap" is derived from the last sale price for the displayed class of listed securities and the total number of shares outstanding for both listed and unlisted securities (as applicable). It does not include securities convertible into the common equity securities. Market Cap (Capitalization) is a measure of the estimated value of the common equity securities of the company or their equivalent. Two analysts have estimated 5.4 billion for Stelara in 2025. patent expires in September, according to Refinitiv data.

#Benchmark analytics stock free#

Register for your free account today at . Analysts currently expect J&J to bring in 54.5 billion in 2025 pharmaceutical sales on average, and for Stelara sales to fall from 9.9 billion this year to 7.5 billion in 2024 after a key U.S. Data Link's cloud-based technology platform allows you to search, discover and access data and analytics for seamless integration via cloud APIs.

Real-time bid and ask information is powered by Nasdaq Basic, a premier market data solution. You can use the bid-ask spread to determine whether to place a market order or limit order when trading, helping you to optimize your price and have a successful order execution. In contrast, a larger spread suggests lower liquidity, as there are fewer investors willing to negotiate.

#Benchmark analytics stock how to#

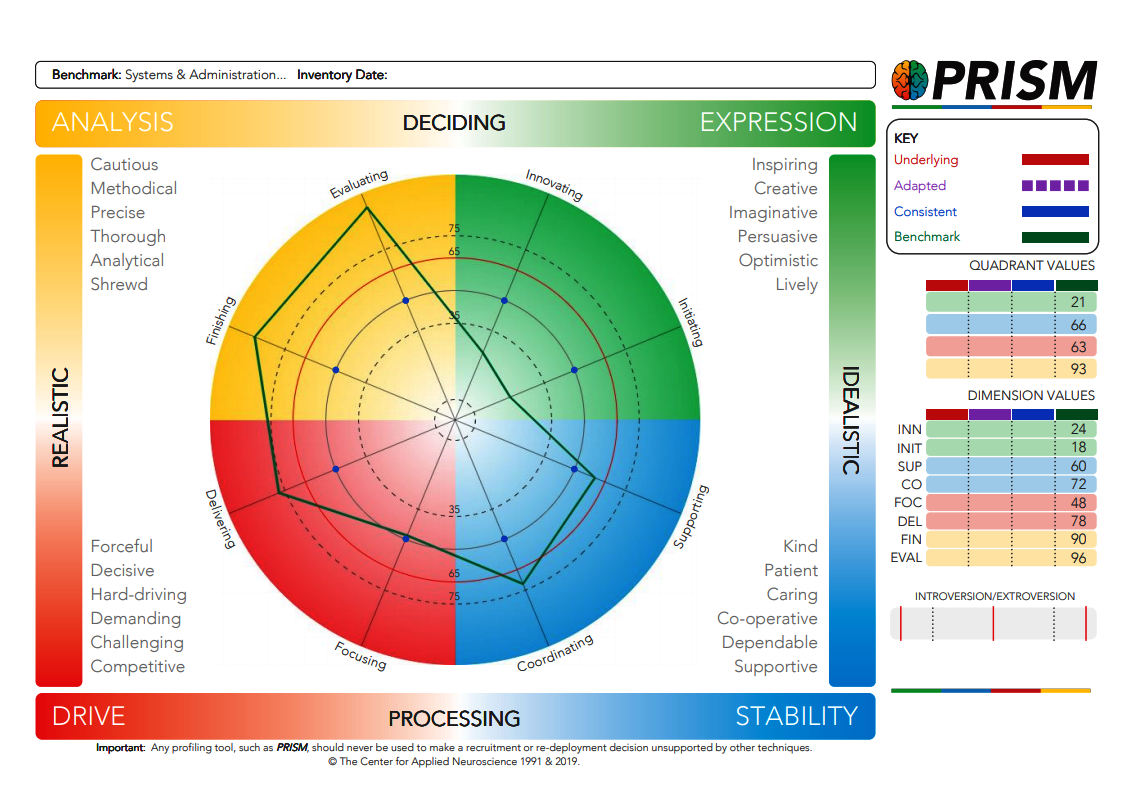

Investors typically use benchmarking to get a better assessment of a portfolio’s return, how risky it is as a whole, and how to allocate funds within the portfolio to minimize risk and boost return.

Often, a smaller spread suggests higher liquidity, meaning more buyers and sellers in the market are willing to negotiate. Stock performance benchmarking is a strategy employed by investors to help determine the different performance aspects of an investment portfolio. The bid-ask spread can indicate a stock’s liquidity, which is how easy it is to buy and sell in the marketplace. The data displayed in the quote bar updates every 3 seconds allowing you to monitor prices in real-time. The bid size displays the total amount of desired shares to buy at that price, and the ask size is the number of shares offered for sale at that price. The numbers next to the bid/ask are the “ size”. amount that a seller is currently willing to sell. The Benchmark stock price prediction module provides an analysis of price elasticity to changes in media outlook on Benchmark Electronics over a specific. The bid is the highest amount that a buyer is currently willing to pay, whereas the ask is the lowest The bid & ask refers to the price that an investor is willing to buy or sell a stock.

0 kommentar(er)

0 kommentar(er)